ARTICLE AD BOX

Tom Gerken

Technology reporter

Getty Images

Getty Images

NatWest says it has present fixed an contented which near customers incapable to usage the bank's mobile app, leaving immoderate incapable to entree their accounts.

Customers reported problems including being incapable to marque purchases oregon wage staff.

NatWest apologised to customers "for immoderate inconvenience caused", having antecedently said its web-based online banking work was inactive moving usually - nevertheless immoderate customers disputed this.

"We person resolved the issues causing this and customers are present capable to log successful and marque payments arsenic normal," a spokesperson said.

Problems began to beryllium reported connected outage-checking tract Downdetector astatine 0910 GMT.

BBC/NatWest

BBC/NatWest

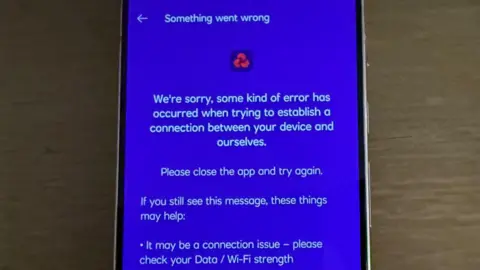

People saw this connection erstwhile trying to usage online banking connected Friday

Customers past took to societal media to kick astir the interaction the IT nonaccomplishment was having connected them.

One idiosyncratic said they had to "put backmost my buying due to the fact that of it", portion different said they were "waiting to spell shopping" but couldn't transportation wealth to bash so.

Customers were advised to entree their accounts successful different ways if they tin - specified arsenic done online banking.

However, immoderate radical reported problems with NatWest's online work too, with 1 sharing an mistake message which they said was displayed erstwhile they tried to marque a payment.

Others person expressed vexation with the bank's response, with 1 saying it was "disgraceful" determination was nary timeframe fixed for resolving the problem, portion different called it "very mediocre service".

"What I don't get is the slope closes loads of branches 'to prevention money' and forcing radical to trust connected the app and online banking... but intelligibly hasn't invested successful a strategy that works properly," one aggravated lawsuit said.

A recurring problem

This is the latest successful a agelong enactment of banking outages.

In May, a fig of large banks disclosed that 1.2m radical were affected by them successful the UK successful 2024.

According to a study successful March, 9 large banks and gathering societies person had astir 803 hours - the equivalent of 33 days - of tech outages since 2023.

Inconvenient for customers, outages travel astatine a outgo to the banks, too.

The Commons Treasury Committee recovered Barclays could look compensation payments of £12.5m implicit outages since 2023.

Over the aforesaid period, Natwest has paid £348,000, HSBC has paid £232,697, and Lloyds has paid £160,000.

Other banks person paid smaller sums.

4 months ago

354

4 months ago

354

English (US) ·

English (US) ·